Why choose IA Check

ImageArchive Check provides any financial institution or business with the most comprehensive in-house or hosted cheque/check imaging products and services. This includes; Remote Deposit Capture, Mobile Capture, Image File Transfer and many other check/cheque services and products offered today. Add IA Exchange to make an electronic check/cheque deposit to your bank or processor.

Check

Check

IA Check/cheque is a powerful, proven and affordable desktop, self-hosted or hosted imaging system. It is easy-to-use, accelerates processing, provides secure storage of vital data/image, and makes it quick and easy to find information.

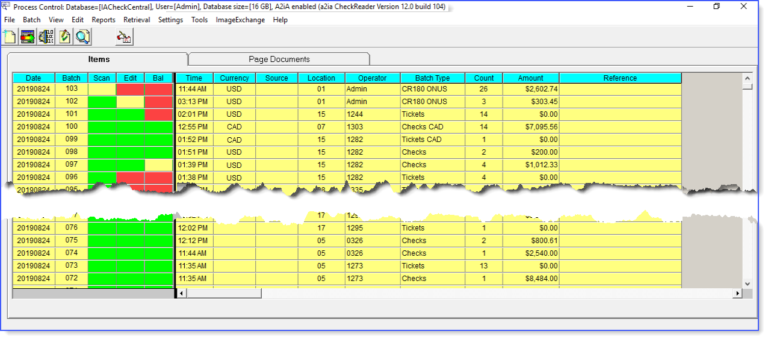

A unique visual workflow interface called ‘Process Control’ displays the status of check batches in progress. All features and stages of the application; Scanning, Importing, Edit/Verifying, Batch Balancing, and Retrieving – are easily initiated and monitored from the process control window. You can see work being created at any workstation across the system and monitor its progress during image capture, verification, editing and balancing right through to Check 21 x9 extraction.

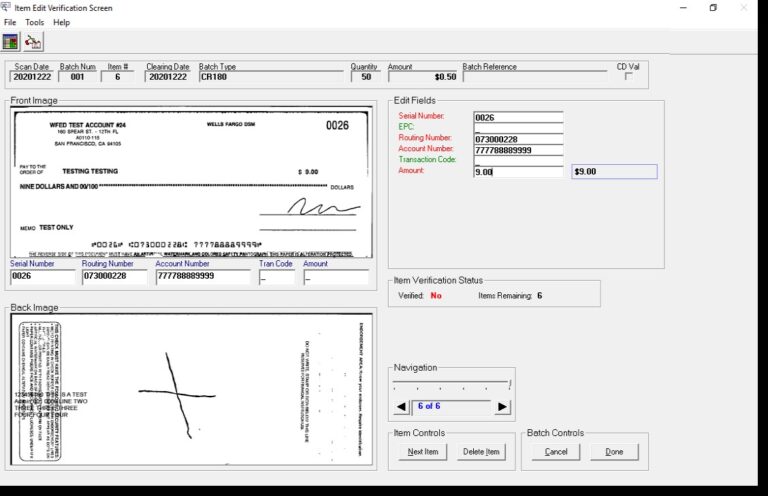

- A check/cheque scanner will scan the front and back of checks, and capture the MICR code line in a single pass. If required a physical or virtual endorsement can be added on the back of the check/cheque. Scanned Images are captured at 100 to 300 dpi, black & white (TIF), gray scale or color (JPEG) formats. The captured images and MICR information are then indexed and stored electronically in the Central Repository.

-

CAR/LAR (Courtesy/Legal Amount Recognition) can be performed on both handwritten and machine written amounts for all images. CAR/LAR Recognition is performed successfully on 85% to 100% of the items (according to geographic location) with over 99.8% accuracy. Items for which the CAR/LAR results are suspect are presented to the user for manual input.

- Users can visually verify the image quality and MICR information of the scanned checks and correct and key enter additional information. Image Zone magnification allows the user to quickly enlarge the image area to verify captured information. IQA/IUA (Image Quality & Usability Analysis) is also performed on all checks to ensure acceptance with electronic exchange standards and any item that does not meet IQA/IUA standards is presented with an explanation, for review and correction.

- Amount limits can be set to enforce visual review of all items exceeding a specific dollar amount, while Signature Verification is used to enforce operator verification and automated comparison of client signatures.

- Duplicate detection is used to identify items that may have been previously captured in order to prevent double posting as a result of operator error and to eliminate fraud.

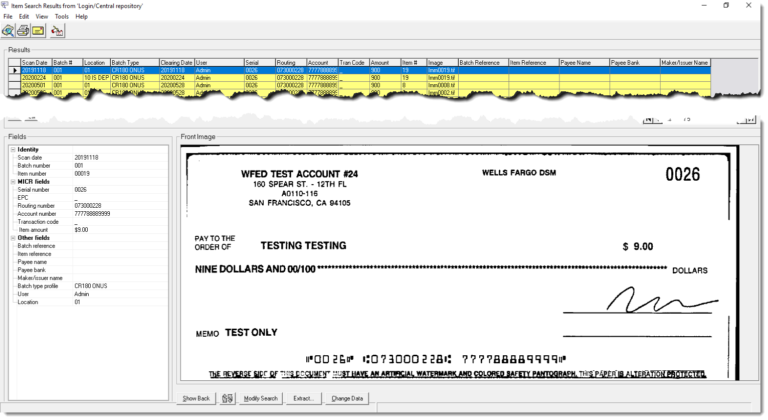

- All Check Images and Data are stored in the IA Central Repository to use for retrievals, reporting or extracting information. Index Fields are set by the user, and data is instantly retrievable using any or all fields. The Retrieval Criteria window (illustrated below) allows for both simple and complex searches. Retrieved images may be output to PDF, printed, faxed or emailed with details of all relevant field information.

FEATURES & BENEFITS

- CAR/LAR (Courtesy/Legal Amount Recognition Software: Feature reduces key amount entry from between 60-80%. (TIFF B/W Image at 200dpi required).

- IQA/IUA (Image Quality & Usability Analysis Software): Required feature to assist in qualification of checks for electronic exchange.

- Extract Formats: Utility provides easy file (MICR/Image) extraction in several ASCII format.

- IA Exchange: Extract & import. Supported formats include; FED X9.37, Canadian ECL X9.100-180 or any other 3rd party formats.

- Document Type Wizard: Ability to add, change or delete document types and to set parameters including required edit/verify fields, batch balance requirements, MICR Extract & Backside Inkjet Endorse option.

- Item Retrieval: Simple & Complex Search Fields with Amount Range Search capability.

- Institution Information: Create profile with institution information and logo, which can be printed on statements/reports.

- Flexible security options: Add or delete users, set passwords and authorization levels.

- Image repository: Secure check/cheque repository.

- Remote deposit capture: capture cheque images and data from remote locations.

- Mobile capture: Capture and send check/cheque images and data from your mobile device.